顏色的選擇,向來是一種自我肯定的傳達媒介,為個人獨特魅力奠定基調,由內而外地實現自我表述。

香奈兒相信色彩的魅力(Color of Allure)可以透過無數方式演繹,即使細微差異也能造就不同,開創無限可能。無論藍色、紅色、米色或金色調,任何色選都能自然展現個人風格,傳遞獨一無二的迷人特質,更成就無限詮釋空間。

「選擇單色妝容,能展現出一個人的堅定與自信。」── Cécile Paravina,香奈兒彩妝創意工作室合作夥伴 COMETES COLLECTIVE 團隊成員之一。

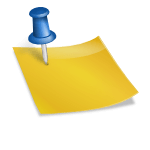

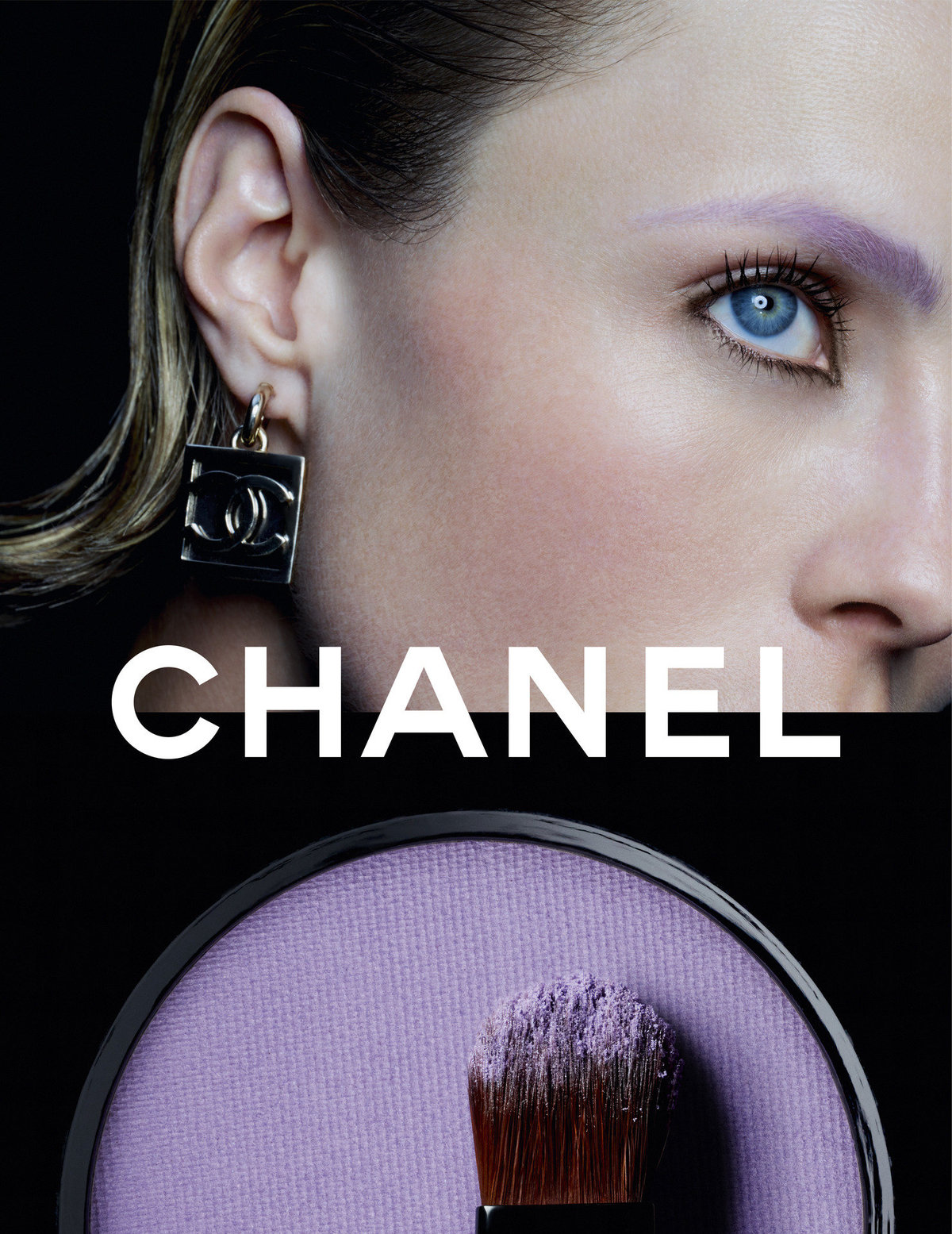

大膽詮釋單色妝容

單色不等於單調,反而更能傳達繽紛多樣的特質,僅以必要元素大膽彰顯魅力。彩妝藝術家 Cécile Paravina 認為,妝容的本質在於讓人做真實的自己,並以此理念孕育出新一代「香奈兒炫彩單色眼影」。一如自我魅力有數千種傳遞方法,同一顏色也能有無數種上妝方式。

一款香奈兒炫彩單色眼影、十四種誘人色選

Cécile Paravina 以香奈兒歷久彌新的豐富歷史為靈感起源,與香奈兒彩妝創意工作室攜手推出全新「香奈兒炫彩單色眼影」,全系列共推出 14 款色選,並將自身的創意世界與香奈兒經典色調完美串聯。

「#242米棕沙發」靈感取自巴黎康朋街 31 號的私人寓所內代表性家具──沙發的顏色。

「#230巴黎灰」源於香奈兒女士諸多作品誕生之地──巴黎,顏色與巴黎公寓的灰色屋頂相仿。

「#240暖棕紅」則源於獅子的棕色,即香奈兒女士的專屬動物圖騰與星座標誌。

「#220珍珠光」象徵點綴著香奈兒女士的高雅裝扮,透出皎潔月光般的珍珠串配飾。

「#246黑色優雅」為香奈兒女士無懼演繹黑色的優雅意象。

「#232紫丁香」則使人聯想到品牌經典元素──斜紋軟呢。

「#228微醺粉漾」詮釋人們肌膚在戶外活動一整天後,自然透出的嫩粉氣色。

「#224金黃麥穗」象徵香奈兒女士視為機遇與幸運象徵的黃金色麥穗。

「#226胭脂緋紅」代表蓬勃的生命力,蘊含著香奈兒女士嚮往的強韌與能量。

「#236可可豆」呼應西敏公爵身著夾克、休閒自在的棕色,也是香奈兒女士時髦氣質的縮影。

「#238煙燻石英」來自香奈兒女士格外鍾愛的茶晶。

「#244 2.55」與 2.55 系列皮包內襯顏色如出一轍。

「#222綠野星辰」的柔和淺綠色,令人憶起香奈兒女士的夏季斜紋軟呢創作。

「#234微光沙灘」則使人回到品牌無數經典作品的發想地──杜維埃,當地遼闊無邊的沙灘。

Cécile Paravina 邀請眾人透過「香奈兒炫彩單色眼影」,盡情玩轉霧面、緞光及金屬光等三種妝效,打造最能展現自我的眼影風格。從紫丁香、綠色、棕色到橘色調,「香奈兒炫彩單色眼影」奔放無極限,可塗抹於眼線、上眼瞼及眉毛,將單色妝容的魅力,透過創意大膽的顏色自信釋放。

一種顏色,三種風格

Cécile Paravina 與香奈兒彩妝創意工作室攜手,從不同視角全面探索單色妝容的迷人之處。她認為,「使用單一顏色,能讓人著重於形狀勾勒與上妝風格」。「香奈兒炫彩單色眼影」使人擁有三種方式上妝,輕鬆詮釋自我的多樣面貌,並隨時隨地打造百變妝容,散發誘人魅力。

為了突顯「香奈兒炫彩單色眼影」多重特點,Cécile Paravina 亦創作出多用途的「#220珍珠光」,可疊擦於其他顏色,單獨使用時則透亮出絢麗虹光,讓雙眼明亮動人。

「顏色是傳達抽象概念與複雜訊息最直接的方式。選擇單色妝容,可以確保傳遞的訊息更強而有力。」── Cécile Paravina,香奈兒彩妝創意工作室合作夥伴 COMETES COLLECTIVE 團隊成員之一。

一款眼影,三種上妝方式

「香奈兒炫彩單色眼影」不僅推出全新色選、全新風格與全新上妝方式,同時全新添加保養成分「鼠尾草油」,擁有如奶油般加倍絲滑的質地,一抹完美貼合眼窩,宛如第二層肌膚般,隨心暈染出各種妝感及濃淡色彩。

妝容一:突顯動人雙眸

彩妝藝術家 Cécile Paravina 祕訣:將眼影大範圍掃於上眼皮直至眼窩位置,妝容更顯大膽。

妝容二:勾勒眼部輪廓

彩妝藝術家 Cécile Paravina 祕訣:使用沾濕錐形刷勾勒出俐落分明的細緻線條。

妝容三:放大深邃雙眸

彩妝藝術家 Cécile Paravina 祕訣:將眼影塗在上眼皮並帶至下眼線,塑造具整體感的無瑕妝容。

誘人魅力,增添一筆

Cécile Paravina 為香奈兒經典產品「香奈兒超炫耀4D修護睫毛膏」研發出三款限量新色,包含:#37紫丁香、#47胭脂紅及 #57甜橙橘,讓色彩的誘人魅力一路延伸至睫毛。與全新「香奈兒炫彩單色眼影」搭配使用,打造出完美同色系妝容,或是增添對比吸睛的妝容亮點。

彩妝藝術家 CÉCILE PARAVINA 祕訣,揭露色彩魅力:

「想要打造亮眼的單色妝容,可以從色彩學的角度出發。例如:可以大膽選擇棕色或橘色眼影作為主調,襯托出迷人的湛藍雙眸;選擇紫色或粉色,使綠眼珠更顯深邃。若瞳色偏棕,則建議選擇偏冷色調。 妝容沒有制式規則,不過如果能記得色彩原理,可以讓眼妝更脫穎而出,雙眸動人有神。

同樣地,色彩原理也有助於激發令人眼睛為之一亮的混搭組合。像是使用『香奈兒炫彩單色眼影 #230巴黎灰』搭配『香奈兒超炫耀4D修護睫毛膏 #47胭脂紅』,就能打造出充滿活力的亮麗妝容!」

香奈兒炫彩單色眼影

-

#220珍珠光

炫彩白光中帶有粉桃色 -

#222綠野星辰

緞光金灰綠色 -

#224金黃麥穗

帶綠色調的金屬黃色 -

#226胭脂緋紅

金屬紅銅色 -

#228微醺粉漾

霧面清新蜜桃色 -

#230巴黎灰

霧面柔灰色 -

#232紫丁香

霧面丁香紫藕色 -

#234微光沙灘(主打)

緞光玫瑰裸粉色 -

#236可可豆(主打)

緞光灰褐色 -

#238煙燻石英

緞光卡其金棕色 -

#240暖棕紅(主打)

霧面紅棕色 -

#242米棕沙發(主打)

霧面駝米色 -

#244 2.55

霧面酒紅色 -

#246黑色優雅

霧面黑色

炫彩單色眼影

NT$ 1420

香奈兒超炫耀 4D 修護睫毛膏(限量)

超炫耀4D修護睫毛膏

NT$ 1560

香奈兒彩妝創意合作夥伴 COMETES COLLECTIVE 團隊宣言

「傷心難過時,就抹上豔彩脣膏主動出擊。」這無疑是嘉柏麗·香奈兒女士最經典的表現,也是香奈兒彩妝的指導原則。這句話微妙表現出女性的無畏、強大與自由,堅定強勢卻令人傾心。

挑選一款香奈兒脣膏擦上的動作,代表說出自己的故事,接納自己的脆弱和釋放自己的渴望。一款脣膏可以變化出無數種妝容,而脣膏留下的一抹豔彩頓時成為最能完美表達自我的方式,也展現你擁有的力量。這抹豔彩隨時給予你肯定,無論有沒有人看見。

色彩對香奈兒來說遠遠超越表面藝術,而是一種深刻想法。紅色成為矚目焦點,穿戴黑色表達見解,藍色讓人天馬行空作夢。而且人人都能熟稔運用色彩來表現自我,隨時隨地、隨心所欲盡顯個性。

香奈兒品牌提供無邊無際的創作空間,讓我們揮灑自由美好的彩妝願景,發明新色彩和嘗試不同質地。我們將盡情運用色彩工具,以前所未有的創新方式描繪美學的未來。此次加入品牌行列,我們將有更多發揮空間,扮演彩妝創作者、彩妝夢想家到彩妝技術專家和彩妝發明者的角色。沒有什麼不可行,唯一任務就是放膽去做。

我們將重新詮釋品牌經典符碼。在核心色彩與誇張色調之間激盪嶄新火花。我們將譜寫新的色彩協奏曲。在香奈兒的實驗精神推動下,結合自己的藝術啟發,以及對美學的共同願景來創作,同時維持香奈兒品牌無與倫比的優雅風格。非常榮幸有這次機會,我們將全力以赴,與香奈兒彩妝創意工作室一同締造最佳成果。

我們對美的願景是什麼?希望美能釋放無窮創意,以彩妝作為共同語言與色彩,譜寫生動而感性的故事。

畢竟,呵護自己,大膽做自己,就是世上最美的事。

香奈兒彩妝創意合作夥伴 COMETES COLLECTIVE 團隊

Ammy Drammeh、Cécile Paravina、Valentina Li

標題:【CHANEL 香奈兒】香奈兒炫彩單色眼影 /

鄭重聲明:本文版權歸原作者所有,轉載文章僅爲傳播更多信息之目的,如有侵權行爲,請第一時間聯系我們修改或刪除,多謝。